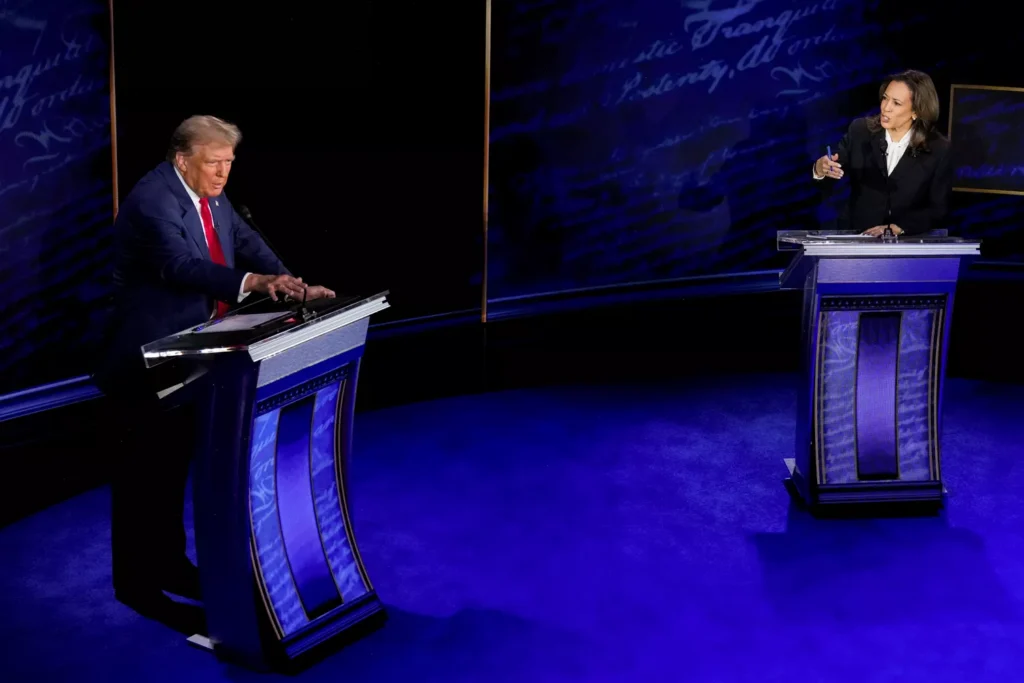

Investors responded to the presidential debate between former President Donald Trump and Vice President Kamala Harris with a clear market shift in politically connected assets. Financial assets tied to Trump retreated early Wednesday as the debate’s outcome was digested by the markets.

Solar and green energy stocks experienced an advance, reflecting investors’ expectations of Harris continuing President Biden’s climate policies if elected. Lithium mining giant Albemarle, solar panel maker First Solar, and green energy utility AES Corp. all saw significant gains, with the Invesco Solar ETF also trading higher despite an inflation report.

The stock of Truth Social’s parent company, Trump Media & Technology Group (DJT), plummeted by 12%, reaching some of its lowest levels ever. This volatility is attributed to its small float and is often seen as a proxy for Trump’s reelection chances.

Bitcoin and other crypto stocks also saw a decline post-debate. Bitcoin’s price dropped from $57,650 at the start of the debate to $56,130 early Wednesday, continuing a downward trend.

Prediction markets showed a higher expectation for a Harris victory after the debate, with Polymarket still favoring Trump and PredictIt increasing the likelihood of a Harris win. The debate covered topics such as the economy, immigration, abortion, living costs, and campaign rally turnouts.

For any news tips or insights, Apexfinancialpath reporters can be reached at tips@apexfinancialpath.com.