Key Takeaways:

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed its iShares Gold Trust (IAU) in net assets, marking a significant milestone in the world of investment trusts. As of Thursday, IBIT’s assets reached $33.2 billion, overtaking the $32 billion held in BlackRock’s gold ETF.

This achievement is notable considering the iShares Gold Trust has been in existence since 2005, while the iShares Bitcoin Trust was only launched earlier this year. Despite starting the year with a $25 billion deficit compared to IAU, IBIT has managed to catch up in just a few months.

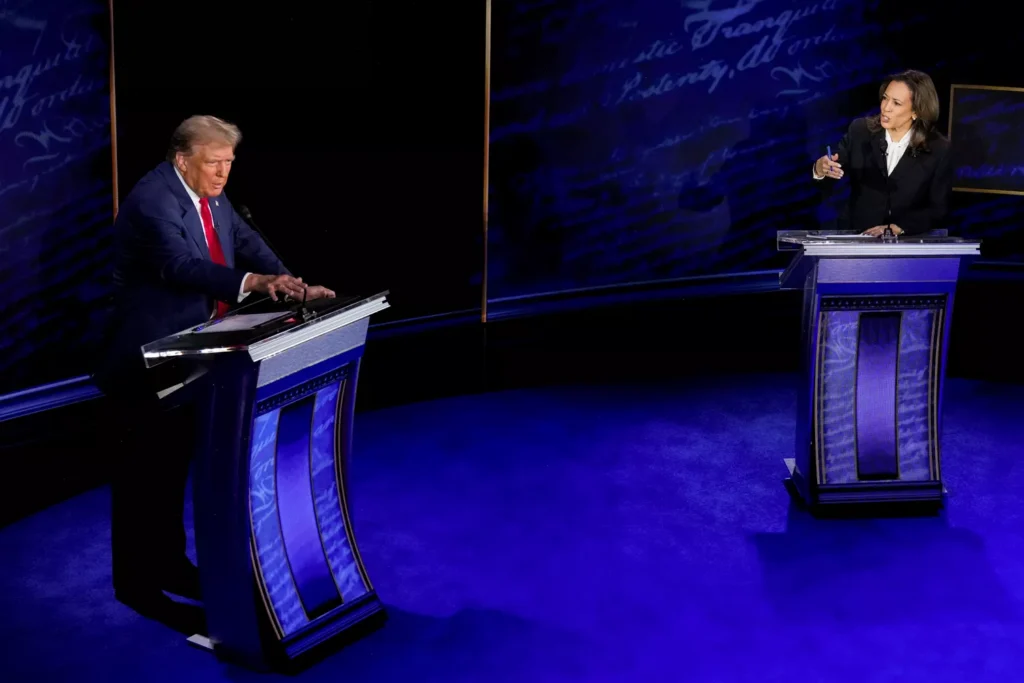

Bitcoin’s performance has been outstanding this year, with an 80% increase in its price, and it recently hit another all-time high, surpassing $77,000 on Friday. This surge in IBIT’s value is attributed in part to the election victory of former President Donald Trump, which spurred a rally in Bitcoin and significant investor inflows.

U.S. spot Bitcoin ETFs saw inflows nearing $1.3 billion on Thursday, with BlackRock’s IBIT accounting for $1.1 billion of that total, setting an all-time high for IBIT and any other Bitcoin ETF.

While gold has also performed well this year, increasing around 80%, Bitcoin has outperformed it. The leading cryptocurrency’s year-to-date performance has been remarkable, making IBIT a standout among investment trusts.

For any news tips, Apex Financial Path reporters can be reached at tips@apexfinancialpath.com.