Key Takeaways: Since the beginning of September, Bitcoin has gained more than 14%, while the S&P 500 has risen roughly 3%. Initially, both Bitcoin and stocks had a rocky start due to economic concerns, but Bitcoin has since gained momentum. Both U.S. presidential candidates have shown support for the crypto industry, which is weighing heavier than economic concerns on investors’ minds.

Bitcoin (BTCUSD) has outstripped the returns of the S&P 500 since the beginning of September, despite its volatility. The largest cryptocurrency has benefited from investor optimism driven by the Federal Reserve’s rate cuts and the U.S. presidential elections, among other factors.

Bitcoin’s Performance in September and October: Just like stocks, Bitcoin didn’t have a particularly great start to September after a worse-than-expected jobs report raised concerns about the health of the U.S. economy. Bitcoin was trading below $60,000 at that time, but signals from the Fed about a potential rate cut coming soon helped the cryptocurrency gain some momentum.

The Fed announced a jumbo 50-basis-point rate cut on Sept. 18 and set expectations for more to come, sending Bitcoin higher. Lower rates translate into lower yields for Treasurys, making riskier assets such as Bitcoin more attractive to investors. However, macroeconomic uncertainty continues to weigh on Bitcoin. Any economic data suggesting that the Fed could deviate from its rate-cutting cycle or that a recession is imminent has the power to derail this Bitcoin rally.

There may also have been a sudden shift out of crypto assets into Chinese equities after the government announced a blockbuster stimulus package in late September. However, that trade has lost some steam as optimism around more measures began fading.

Factors Driving Bitcoin Prices: Bitcoin traded around $68,000 on Wednesday after three robust days of inflows for Bitcoin exchange-traded funds (ETFs). According to data from Farside Investors, Bitcoin ETFs have seen nearly $1.2 billion in net inflows since last Friday.

U.S. presidential elections have also played a role in Bitcoin price movements this year. Researchers at Coinbase wrote, ‘The macro factors contributing to crypto performance are currently rotating away from monetary policy concerns to US election outcomes.’

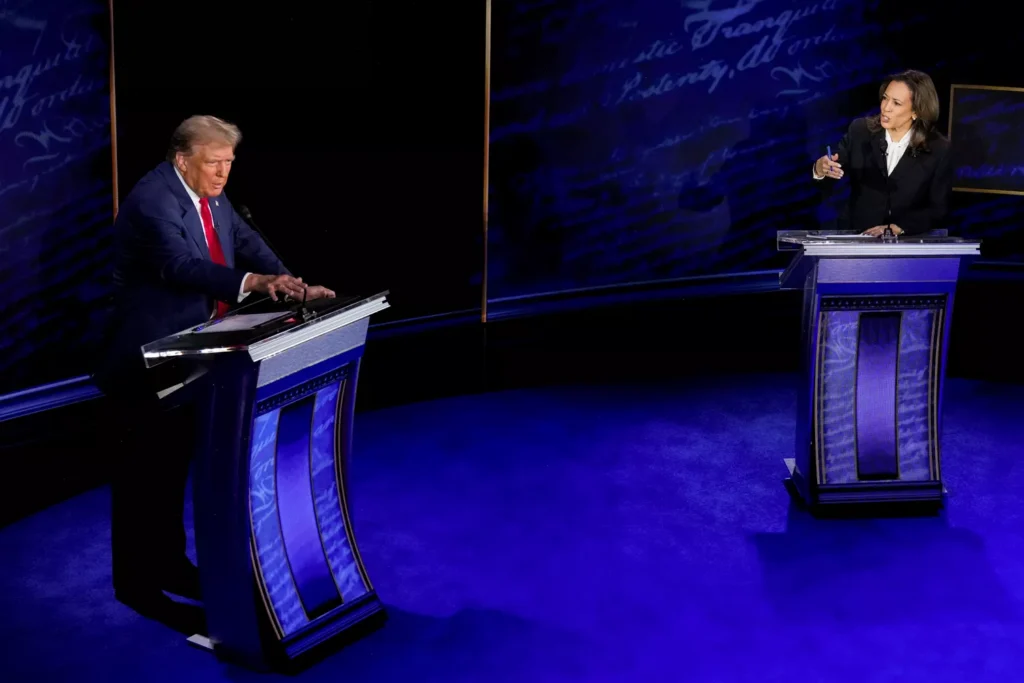

As part of a campaign agenda released Monday, Vice President and Democratic presidential nominee Kamala Harris mentioned ‘supporting a regulatory framework for cryptocurrency and other digital assets.’ This was the first time the Harris campaign showed some support for the crypto industry, while her opponent former President Donald Trump has done so on many occasions.

The recent surge in Bitcoin ETF investments has been significant, with more than $500 million being pushed into the market.

Another factor contributing to the boost in Bitcoin prices is the failed cryptocurrency exchange, Mt. Gox. The exchange announced that it will repay customers affected by a decade-old hack by October 2025, instead of this month as previously planned.

Market observers were concerned about a rapid drop in Bitcoin prices due to a substantial influx of Bitcoin into the market as repayments began in June. However, this new repayment schedule could alleviate short-term supply concerns, as stated by Coinbase researchers.

They also noted that previous movements in Bitcoin wallets associated with Mt. Gox have historically led to sudden declines in Bitcoin prices.

For any news tips, Apex Financial Path reporters can be reached at tips@apexfinancialpath.com.