Bitcoin reached a significant milestone on Tuesday, racing past the $73,000 mark and nearing its all-time high set in March. This surge in Bitcoin also had a positive impact on MicroStrategy’s stock, which hit a 52-week high.

Trading activity in Bitcoin-related investments has seen a noticeable uptick in anticipation of the U.S. elections, according to analysts. Bitcoin traded around $73,000 on Tuesday, gaining momentum as investors poured billions into spot Bitcoin exchange-traded funds. The cryptocurrency’s momentum brings it within striking distance of its all-time high price of $73,798, set earlier this year.

This momentum also propelled shares of MicroStrategy, which held over 252,000 Bitcoin on its books as of September 19, to a 52-week high of $267.89. Other Bitcoin-related companies, such as Coinbase Global and Marathon Digital parent company MARA Holdings, saw their shares rise as well. MicroStrategy and Coinbase are set to report earnings tomorrow.

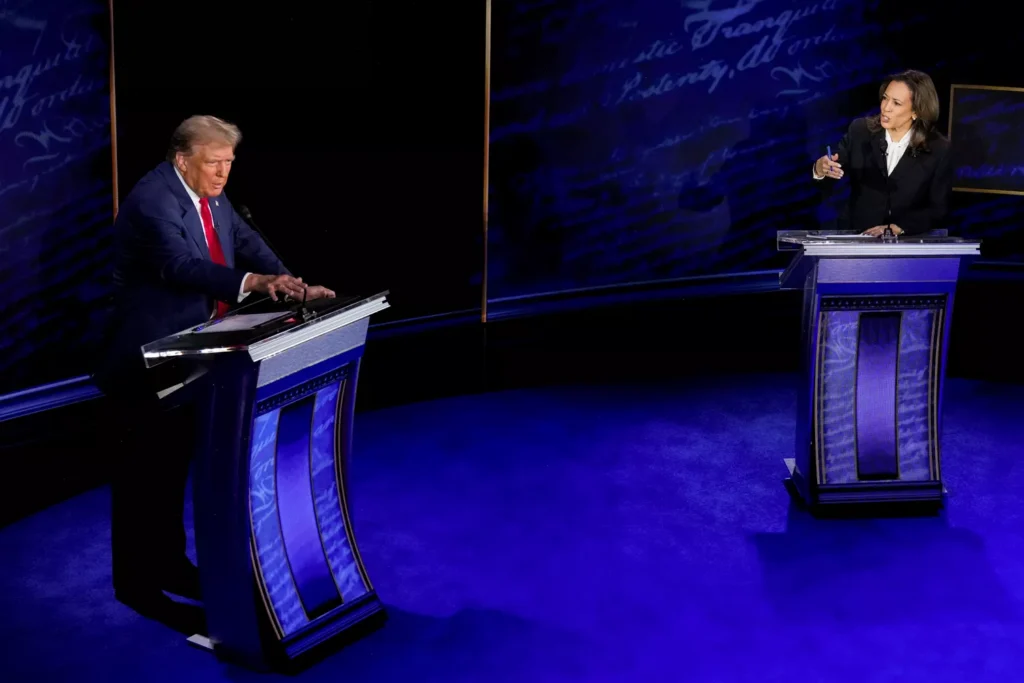

As Election Day approaches, Bitcoin trading activity is on the rise. Both former President Donald Trump and Democratic Vice President Kamala Harris have made efforts to engage with the crypto community. Trump embraced crypto earlier this year, while Harris has discussed her approach in recent months.

Since October 11, spot Bitcoin ETFs have received net inflows of nearly $4 billion, with only one day experiencing money flowing out. Spot Bitcoin ETFs hold Bitcoin, and increased demand for the product contributed to driving Bitcoin to all-time highs earlier this year.

Trading activity has also increased in Bitcoin derivatives products, such as futures and options. According to Coinbase Research, open interest, which is the total number of outstanding derivative contracts and serves as a gauge of investor interest, rose significantly in CME Bitcoin futures in October compared to September.

Bitcoin options contracts trading on crypto exchange Deribit, expiring on November 8, the Friday after the election, have experienced a spike in activity, as reported by Kaiko Research. The majority of activity is clustered around the $65k to $80k range, implying that traders expect prices to trade around record highs post-election.

If you have a news tip for Apex Financial Path reporters, please email us at tips@apexfinancialpath.com